Vietnam's Foreign Investment Policies

December 23, 2024

Vietnam's proactive approach to attracting FDI has yielded impressive results. The country has become a prime destination for foreign investment in Southeast Asia, particularly in manufacturing. However, it's important for potential investors to recognize that Vietnam investment policy is not without limits.

Vietnam has emerged as a dynamic player in the global economy, attracting foreign investors with its rapid growth and strategic location. The country’s approach to foreign investment is a careful balancing act, combining welcoming policies with strategic restrictions. This comprehensive overview explores Vietnam’s foreign investment landscape, highlighting both the opportunities and challenges for foreign investment in Vietnam.

1. Policies conducive to foreign investment

Vietnam has made significant strides in opening its doors to foreign investors. The government actively seeks FDI at both central and municipal levels, implementing policies that are generally conducive to international investment. Here’s how Vietnam is rolling out the red carpet.

1.1 General openness and incentives

Vietnam’s welcoming stance towards foreign investment is reflected in several key policies:

- Negative list approach: Unlike many countries that specify where foreign investment is allowed, Vietnam uses a “negative list” approach. This means foreign businesses can operate in all sectors except for (a) prohibited sectors, or (b) Negative List for Market Access, signaling a broad openness to international participation in the economy.

- Equal treatment guarantee: To instill confidence in foreign investors, Vietnamese law mandates equal treatment of foreign and domestic investors in cases of nationalization and confiscation. This legal protection helps mitigate political risk for international firms.

- Targeted incentives: Vietnam offers a suite of investment incentives tailored to attract investment in priority sectors. These include:

- Lower corporate income tax rates

- Exemptions on import tariffs

- Favorable land rental rates

These incentives are particularly generous in sectors deemed crucial for Vietnam’s development, such as advanced technology, R&D, renewable energy, software development, and education.

1.2 Targeted sectors for FDI

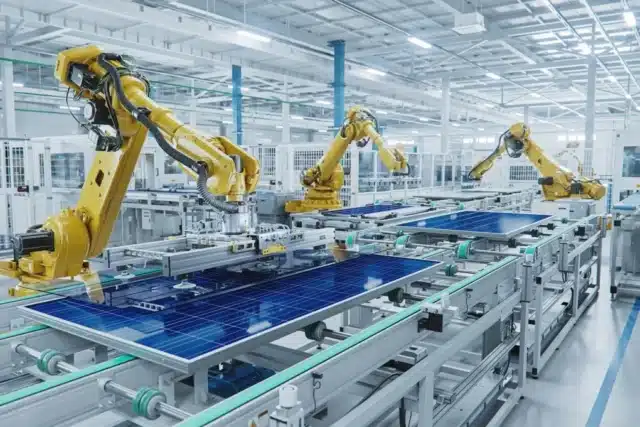

Vietnam’s investment policies reveal a strategic focus on attracting FDI in sectors that can drive long-term economic growth and development:

- The Law on Investment provides financial incentives for FDI in areas such as university education, pollution mitigation, and specific types of medical research. This approach aims to leverage foreign expertise and capital to address key developmental challenges.

- The Public Private Partnership Law identifies critical infrastructure sectors as priorities for FDI and public-private partnerships. These include transportation, electricity generation and distribution, water management, healthcare, education, and IT infrastructure. By prioritizing these sectors, Vietnam seeks to address infrastructure gaps that could otherwise constrain economic growth.

1.3 Administrative reforms

Recognizing that bureaucratic hurdles can deter foreign investment, Vietnam has initiated several reforms to simplify administrative processes:

- E-Government initiatives: The government is actively developing e-Government platforms and single window services. These digital solutions aim to reduce paperwork, increase transparency, and accelerate approval processes for foreign investors.

- Centralized information access: Vietnam has established a nationwide business registration site and provides comprehensive information on investment regulations through the UNCTAD international network. This centralized approach to information dissemination makes it easier for potential investors to understand and navigate Vietnam’s regulatory landscape.

1.4 Foreign trade zones and industrial parks

Vietnam has made strategic use of special economic zones to create pockets of even greater openness to foreign investment:

- Over the past decade, Vietnam has prioritized the establishment of various types of foreign trade zones (FTZs). Today, the country boasts more than 350 Industrial Zones (IZs) and Export Processing Zones (EPZs).

- These zones offer significant advantages to foreign investors:

- Enterprises in FTZs enjoy duty-free import of raw materials when the finished products are exported.

- Companies operating in these economic zones benefit from additional tax reductions, further incentivizing investment.

By concentrating these incentives in specific areas, Vietnam can offer highly competitive conditions to foreign investors while gradually preparing the broader economy for increased international competition.

2. Policies that restrict/limit foreign investment

While Vietnam has made significant progress in opening its economy, some restrictions remain in place to safeguard national interests and support domestic industries. Understanding these limitations is crucial for foreign investors looking to enter the Vietnamese market.

2.1 Sector-specific restrictions

Vietnam maintains statutory restrictions on foreign investment in certain sectors, including:

- Banking

- Network infrastructure services

- Non-infrastructure telecommunication services

- Transportation

- Energy

- Defense

The government has a list of 25 business lines in which foreigners are prohibited from investing and 59 other business lines subject to market access requirements according to Decree 31/2021/ND-CP.

2.2 Foreign ownership limitations

While the government intends to remove foreign ownership limits in most industries, some restrictions remain. Some of the sectors still subject to foreign ownership include banking, non-bank credit institutions, aviation, land transportation, sea transportation, logistics.

2.3 Land ownership and use restrictions

- Neither foreigners nor Vietnamese nationals can own land, as it is collectively owned and managed by the State.

- Foreign investors can lease land for renewable periods of 50 years, and up to 70 years in some underdeveloped areas.

- The government can reclaim land if it is not used according to the land-use rights certificate or if it is unoccupied.

2.4 Investment approval process

Investment approval process includes several layers of scrutiny:

- All FDI projects require approval by the People’s Committee in the province where the project would be located.

- Large-scale FDI projects must also obtain approval from the National Assembly before investment can proceed.

- Certain projects require the Prime Minister’s approval, including those related to airports, seaports, casinos, oil and gas, telecommunications, publishing, and projects that need approval from more than one province.

2.5 National security considerations

Vietnam places a strong emphasis on national security in its investment policies:

- The government can stop foreign investments if it deems them harmful to Vietnam’s national security.

- The Law on Investment 2020 adds a condition that investments must not compromise national defense and security, though this term is not clearly defined.

2.6 Data localization and cybersecurity requirements

Recent legislation has introduced new requirements for businesses operating in Vietnam:

- The Law on Cybersecurity requires cross-border services to store data of Vietnamese users in Vietnam and establish local presence.

- A draft Personal Data Protection Decree includes provisions for data localization, local presence, licensing, and registration procedures for personal data.

2.7 Performance requirements

Vietnam imposes certain performance requirements on foreign investors. These requirements allow the government to ensure that foreign investments contribute to Vietnam’s economic development goals:

- While the Law on Investment prohibits certain performance requirements, there are additional market entry requirements and limitations for investments in “conditional” sectors.

- Investors must obtain formal approval, in the form of business licenses or other certifications, to satisfy “necessary conditions” in certain sectors.

2.8 Currency and remittance restrictions

Vietnam maintains some control over currency transactions and profit remittance to manage its foreign exchange reserves and maintain economic stability:

- In-country transactions must be made in the local currency (Vietnamese dong).

- While foreign companies can legally remit profits, they often face bureaucratic difficulties and are required to provide extensive supporting documentation.

3. International regulatory considerations influencing Vietnam’s foreign investment regulations

Vietnam’s foreign investment policies are not created in isolation. As an increasingly active player in the global economy, the country’s regulations are shaped by its participation in various international organizations and agreements. Understanding these influences provides crucial context for potential investors.

3.1 Regional integration: ASEAN and APEC

Vietnam’s membership in regional organizations plays a significant role in shaping its economic policies:

- As a member of ASEAN, Vietnam is part of the ASEAN Economic Community (AEC), which aims to establish a single market across member nations. This membership drives Vietnam’s efforts towards economic integration and tariff reduction.

- Vietnam’s participation in APEC (Asia-Pacific Economic Cooperation) encourages the facilitation of business among member states through various trade facilitation programs.

3.2 Global trade commitments: WTO and Free Trade Agreements

Vietnam’s global trade commitments have a substantial impact on its investment landscape:

- As a WTO member, Vietnam is implementing the Trade Facilitation Agreement (TFA), with full implementation of all provisions expected by 2024.

- Vietnam is a party to 16 free trade agreements, including the EU-Vietnam Free Trade Agreement (EVFTA) and the Regional Comprehensive Economic Partnership (RCEP). These agreements often require Vietnam to implement investor-friendly reforms and provide better market access.

3.3 Bilateral investment treaties and international arbitration

Vietnam has established a network of agreements to protect foreign investments:

- The country has signed 67 bilateral investment treaties and is party to 26 treaties with investment provisions.

- As a party to the New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards, Vietnam’s courts are required to recognize foreign arbitral awards from recognized international institutions.

3.4 International standards and best practices

Vietnam is actively working to align its practices with international standards:

- The country engages with the OECD on various policy reviews and participates in the OECD-Southeast Asia Corporate Governance Initiative.

- Vietnam is transitioning towards International Financial Reporting Standards (IFRS), with a goal of widespread adoption by 2025.

- The country is preparing to accede to key intellectual property treaties and is a member of the OECD Inclusive Framework on Base Erosion and Profit Shifting.

These international commitments and standards demonstrate Vietnam’s dedication to creating a more transparent, predictable, and globally integrated business environment. For foreign investors, this ongoing evolution presents both opportunities and challenges.

Vietnam’s investment policies are a mix of welcoming rules and careful limits. This means there are great opportunities, but also some challenges to watch out for.

Talentnet today can help you turn Vietnam’s investment opportunities into business success. We’re Vietnam’s top HR and payroll service provider. Our services help foreign companies set up and run their businesses in Vietnam such as:

- HR compliance guide: We offer a guide that explains Vietnam’s labor laws and HR rules. This helps you avoid mistakes when hiring and managing workers in Vietnam.

- Compliance help: Our team makes sure your business follows all of Vietnam’s laws and rules. We handle things like labor contracts and social insurance requirements.

- Licensing support: We help you get the business licenses you need to operate in Vietnam. We also provide ongoing support to keep you compliant as your business grows.

Want to learn more about how Vietnam’s investment policies might affect your business? Contact Talentnet today.