Why Invest in Cambodia? Growth & Opportunities

February 19, 2025

According to World Bank, Cambodia's economy is projected to grow at an impressive 5.8% in 2024, outpacing many of its Southeast Asian neighbors, even reaching an all-time high of 13.30% in 2005, before the 2008 crisis. Its positive reforms and steady growth make it an increasingly appealing destination, offering a unique chance to establish a competitive investment in cambodia.

Key Takeaways:

- Cambodia’s strong economy, projected by sources like the Asian Development Bank to grow 6.0-6.3% in 2025, offers a stable base for investment.

- New laws actively encourage foreign investment through equal treatment, 100% foreign ownership in most sectors as outlined in investment regulations, and attractive tax benefits.

- Membership in ASEAN and participation in key trade deals like RCEP provide excellent access to regional and global markets.

- Investment opportunities extend beyond traditional sectors into manufacturing (highlighted in recent investment reports), infrastructure, and tourism (both noted in economic outlooks).

- Be aware of potential governance issues reflected in global indices and infrastructure challenges noted in business environment reports; careful planning and local advice are essential for success.

For leaders exploring growth opportunities in Southeast Asia, Cambodia presents an increasingly attractive option. The country stands out for a strategy combining strong economic expansion with improved, investor-focused laws. Supported by its strategic ASEAN location and offering potential across diverse sectors, Cambodia is actively working to become a prime destination for foreign investment in Cambodia. While challenges exist, particularly around governance and infrastructure, the overall direction makes a powerful case for why invest in Cambodia now. This article explores the key factors making Cambodia attractive and the specific investment opportunities in Cambodia leaders should evaluate.

Strong Economic Growth Creates a Solid Foundation

Cambodia’s sustained economic growth is a major draw for investors. Projections from sources like the Asian Development Bank estimate GDP expansion between 6.0% and 6.3% for 2025, building towards an expected 6.4% in 2026. This follows impressive historical performance, averaging 6.91% annual GDP growth from 1994 to 2023.

Growth is driven by several factors, including a revival in garment and footwear exports, a solid recovery in tourism detailed in recent economic outlooks, and an increasingly diverse economy where services contribute a significant 38% to GDP. Importantly for business strategy, this expansion is happening within a stable macroeconomic environment.

Macroeconomic forecasts show controlled inflation expected around 2% in 2025, supporting effective business planning alongside a steady exchange rate. Underpinning this momentum is a clear national ambition outlined in development plans: Cambodia aims to become an upper middle-income country by 2030 and a high-income nation by 2050, signaling long-term market potential.

Favorable Investment Framework Attracts Foreign Capital

Cambodia has significantly updated its investment rules to attract foreign businesses looking to invest in Cambodia.

Modernized Investment Law (2021)

The 2021 Investment Law is key to this effort. As detailed by organizations like Open Development Cambodia and UNCTAD, it aims to create an open, transparent, predictable, and competitive legal framework for investors, aligning regulations closer to ASEAN best practices and simplifying procedures.

Equal Treatment and Ownership Rights

A core principle, guaranteed under the Law on Investment, is non-discrimination: foreign investments receive the same treatment as domestic ones. Crucially, Cambodia allows 100% foreign ownership in most business sectors, as confirmed by the Investment Law and various investment guides, without needing special approvals beforehand (land ownership remains restricted). Investment analysts point out foreigners can obtain 100% freehold ownership of condo units and commercial offices.

Attractive Incentives for Qualified Projects (QIPs)

The government also offers compelling incentives for specific Qualified Investment Projects (QIPs). Government resources detail benefits including profit tax exemptions for up to nine years and exemptions from import duties on essential items like production equipment, construction materials, and manufacturing inputs. Extra incentives are available for investments in strategic priority sectors like high-tech industries, R&D, and innovation.

Streamlined Approval Process

To save investors time, Cambodia has simplified investment procedures. Information from construction news sources and business guides indicates a simplified one-stop online portal helps centralize and speed up investment applications. Government ministries are required by the updated Investment Law to review and decide on QIP applications within 20 working days, reflecting a commitment to efficiency.

|

Cambodia’s 2021 Investment Law signals stability. By establishing equal treatment, faster approvals, and regional alignment, it aims to provide the stable and transparent environment needed for long-term investment confidence. |

Strategic Advantages Enhance Market Access and Operations

Cambodia benefits significantly from its location and international connections.

Access to ASEAN and Regional Markets

ASEAN membership provides businesses in Cambodia with preferential access to a huge regional market serving nearly 700 million consumers, a key point highlighted by investment analysts. Regional analysts note this integrated market has a combined economy exceeding $3 trillion. This integration facilitates regional trade, helps diversify economic partners, and has demonstrably increased Cambodia’s exports to fellow ASEAN nations (e.g., rising from 4.3% in 2000 to 22.1% in 2017).

Extensive Free Trade Agreement Network

Cambodia also gains from numerous Free Trade Agreements (FTAs) established under the ASEAN framework, including deals with major partners like China and South Korea. Moreover, its participation in the Regional Comprehensive Economic Partnership (RCEP) connects it to one of the world’s largest trading zones, offering significant market access. These agreements act as powerful “magnets for foreign investors,” lowering trade barriers.

Favorable Financial Environment

International business operations are made easier by Cambodia’s highly dollarized economy, a feature often cited by investment advisors, which simplifies transactions and reduces FX risk. Additionally, the country features no currency controls. Investment guides confirm this allows unrestricted foreign exchange operations through authorized banks (simple reporting is typically required only for transfers exceeding $10,000).

Diverse Investment Opportunities Across Key Sectors

The Cambodian government actively promotes investment across 19 priority sectors, showing a clear strategy for economic diversification. Key investment opportunities to Invest in Cambodia include:

- High-Tech & Innovation: Special priority is given to investments incorporating Research & Development (R&D) and innovation, aiming to foster higher value-added industries.

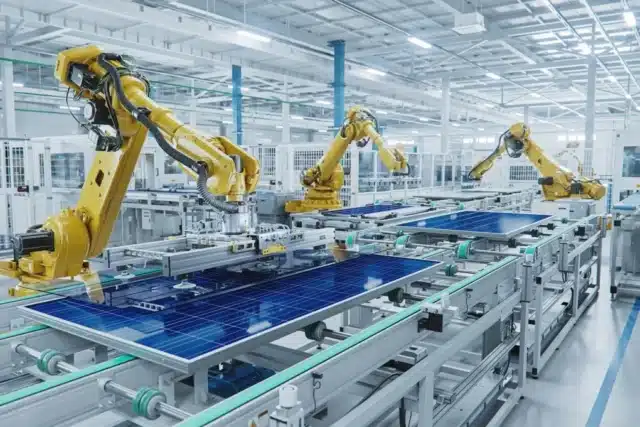

- Manufacturing: While garments and textiles remain important, opportunities are rapidly expanding into automotive parts (seen with Ford’s assembly plant), car tire production, electronics, metal processing, plastic products, and industries feeding global supply chains (evident in reports from sources like Xinhua). Addressing potential manufacturing workforce challenges proactively is important. The 30+ operational Special Economic Zones (SEZs) facilitate this, exporting over $5B annually as of 2024, according to reports from ASEAN Briefing and local news outlets.

- Agriculture & Agro-Processing: With strong resources in rice, cassava, rubber, and as the world’s second-largest raw cashew producer, Cambodia offers solid potential for agro-processing ventures, supported by modernization efforts (e.g., EU investment).

- Renewable Energy & Infrastructure: Interest in renewable energy is high, with renewable sources now powering over half its grid, according to energy sector reports, including new solar projects highlighted by business news sources. At the same time, significant infrastructure needs (estimated at $28 billion by 2040) create vast opportunities, particularly in transportation, logistics, and energy, often pursued via Public-Private Partnerships detailed in economic outlooks (e.g., Techo Airport).

- Tourism & Hospitality: Built on world-renowned cultural assets like Angkor Wat, the tourism sector is recovering strongly, with arrivals reaching 81.3% of pre-pandemic levels in early 2024 and aiming for 7.5 million international visitors in 2025, according to Ministry of Tourism forecasts. The sector contributes about 12% to GDP, based on economic analyses.

- Financial Services: Success stories like ABA Bank demonstrate the proven potential within the financial sector for investment companies in Cambodia operations and growth.

Competitive and Growing Workforce

Cambodia’s demographics are a valuable asset. Approximately two-thirds of the population is under 35 years old, a demographic advantage noted by investment analysts, offering a young and abundant labor pool.

The 2019 census counted 8.2 million people in the prime working-age group (15-64), coupled with low official unemployment rates (1.2%).

Labor costs are also competitive; the 2024 minimum wage in the key textile, garment, and footwear sector was set at USD 204 per month, supplemented by various allowances. Accessing accurate salary market data in Cambodia is key for precise budgeting, and understanding that paying right matters strategically is crucial.

Furthermore, the government recognizes the need for upskilling, implementing initiatives like the Technical and Vocational Education and Training (TVET) program, which aims to train 1.5 million young Cambodians in industry-relevant skills.

|

Cambodia’s young population offers more than just competitive labor costs. Government training programs show commitment to building the skilled workforce needed for advanced industries, linking human capital to economic strategy. |

Strong Investment Protection and Profit Repatriation

Certainty regarding investment security and capital movement is vital. Cambodia’s legal framework provides explicit protections.

Comprehensive Legal Guarantees

The Law on Investment provides robust guarantees, including non-discrimination against foreign investors, protection against unwarranted nationalization or expropriation, and safeguards for intellectual property. Investors are also permitted by law to employ the qualified foreign employees needed for their operations. These protections are often further reinforced by bilateral investment treaties (BITs) Cambodia has signed.

Unrestricted Repatriation of Profits and Capital

The law guarantees investors the right to freely purchase foreign currencies through the banking system and remit them abroad to meet investment-related financial obligations. Specifically for QIPs, as stipulated in the investment regulations, this includes the ability to freely repatriate legitimate profits after tax, royalties, management fees, loan repayments, and invested capital upon dissolution or sale of the business.

Proven Success Stories Validate Potential

These theoretical advantages translate into tangible success stories, validating Cambodia’s potential. ABA Bank, acquired by the National Bank of Canada, has grown into one of Cambodia’s largest banks and continues to attract significant capital, including a reported $220 million infusion in 2024.

The Sihanoukville Special Economic Zone (SSEZ) hosted 170 manufacturing firms by the end of 2021, directly creating nearly 30,000 local jobs, showcasing the model’s effectiveness.

Additionally, investments like Ford’s vehicle assembly plant demonstrate Cambodia’s growing capacity to attract more complex manufacturing beyond traditional sectors.

While the opportunities in Cambodia are significant, prudent leaders must also acknowledge and plan for potential challenges. Governance requires attention, reflected in global metrics like the Corruption Perceptions Index (where Cambodia ranked 158th out of 180 countries in 2024). This highlights the need for thorough due diligence and potentially leveraging expert HR compliance services in Cambodia to ensure adherence.

Infrastructure, despite significant ongoing investment detailed in economic reports, still has gaps, particularly in consistent electricity supply (which can lead to higher costs) and transportation logistics, as noted in business environment analyses. These should be factored into planning.

Finally, while laws are progressive according to policy reviews, practical implementation can sometimes be inconsistent across different agencies or regions, based on business climate reports, making experienced local HR consulting guidance valuable for navigating the regulatory environment smoothly.

For leaders looking for long-term growth in the dynamic Southeast Asian market, Cambodia warrants serious consideration. Cambodia stands at an important point, offering an attractive combination of high economic growth. However, capitalizing on this potential requires a realistic approach. Successful investment in Cambodia requires careful research and understanding the specific rules of your chosen industry, possibly working with advisors with strong local knowledge.

Ready to explore how Cambodia’s dynamic market and talent pool can fit into your regional growth strategy? Contact Talentnet Cambodia today to discuss bespoke talent solutions for your potential Cambodian venture.