Labour Regulations Update in January 2023

January 30, 2023

All information in this document is for reference and general guidance only. It is not an official advice for specific case.

I. Removing the household registration book in the documents proving dependents

On December 30th, 2022, the Ministry of Finance issued the Circular No. 79/2022/TT-BTC amending and supplementing some legal documents promulgated by the Ministry of Finance (“the Circular 79”).

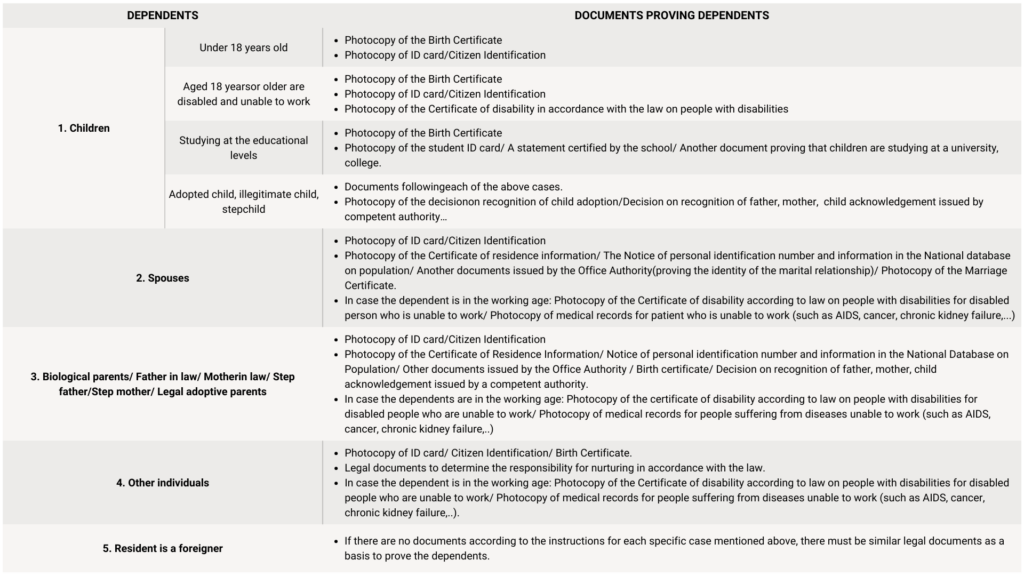

Accordingly, from January 01st, 2023, the Circular 79 supplements the Citizen Identification, the Certificate of residence information or the Notice of personal identification number and information in the national database on population residence or other papers issued by the Office Authority in the documents proving the dependents; and at the same time removes the regulation on Household registration book in the documents proving dependents. Specifically:

From the date on which the tax authority announces the completion of the data connection with the National Population Database, the taxpayer is not required to submit the above-mentioned documents proving the dependents if the information in these documents has already incorporated into the National Database of Population.

The Circular 79 takes effect from January 01st, 2023.

On December 31st, 2022, the Ministry of Health issued the Circular 18/2022/TT-BYT amending and supplementing some articles of the Minister’s Circular No. 56/2017/TT-BYT dated December 29th, 2017 details the implementation of the Law on Social Insurance and the Law on Occupational Safety and Hygiene in the health sector (“the Circular 18”). Accordingly, the Circular 18 stipulates a number of notable points as follows:

- In the illness case which receives the one-time social insurance allowance.

Except for cases of being infected with one of the life-threatening diseases such as cancer, polio, ascites cirrhosis, leprosy, severe tuberculosis, HIV infection that has progressed to AIDS specified at point c clause 1 Article 60 of the Law on Social insurance, people suffering from diseases have a working capacity reduction of 81% or more and cannot control themselves or cannot do activities to serve personal daily living needs but need other people to follow, help, and take care completely are entitled to receive one-time social insurance allowance. - Issuance of a new template of certificate of leave under social insurance benefits.

- Issue a Certificate of leave under social insurance benefits:

- One examination only issues one Certificate of leave under social insurance benefits. In case the patient needs to take leave for longer than 30 days, when the leave period stated on the Certificate of leave under social insurance benefits expires or is about to expire, the patient must conduct a re-examination for the practitioner to consider and decide.

-

In case an employee is examined by two or more specialties from different medical examination and treatment establishments at the same time and is granted a Certificate of leave under social insurance benefits, he/she shall only be inherited one of the certificates with the longest leave period.

-

In case an employee is examined in many specialties on the same day at the same medical examination and treatment facility with many different diseases, only one Certificate of leave under social insurance benefits shall be granted and the employee shall receive social insurance benefits for the disease with the highest benefits.

-

In case a patient is treated for tuberculosis under the National Tuberculosis Program, the maximum leave time shall not exceed 180 days for a single issuance of a Certificate of leave under social insurance benefits.

- In case an employee suffers a miscarriage, abortion, curettage, abortion, or stillbirth with a gestational age of 13 weeks or more, the maximum leave period is prescribed in the Law on Social Insurance but shall not exceed 50 days for a single issuance of the Certificate of leave under social insurance benefits.

- Issuance of Hospital Checkout Certificate and Certificate of leave under social insurance benefits for people infected with Covid-19 treated at medical examination and treatment establishments, specifically:

- In case a patient was issued a Certificate before the effective date of the Circular 18 (February 15th, 2023) but did not follow the form prescribed in the Circular No. 56/2017/TT-BYT, the medical examination and treatment establishment takes responsibility for re-issuance the Certificate in accordance with this Circular 18.

-

In case the employee was treated for Covid-19 but was not issued a Certificate of Hospital checkout or a Certificate of leave under social insurance benefits, the medical examination and treatment facility where the employee was treated for Covid-19 shall base on that person’s request and the medical records to issue a Certificate of Hospital checkout or a Certificate of leave under social insurance benefits.

In case the Covid-19 treatment facility has been dissolved, the medical examination and treatment facility which is assigned to manage and operate the Covid-19 treatment facility as prescribed in clause c section V Decision No. 4111/QD-BYT will be responsible for granting or re-issuing or new-issuing a Certificate of Hospital checkout or a Certificate of leave under social insurance benefits.

The Circular 18 shall take effect from February 15th, 2023.

Contact information

For further information on the latest labor regulation updates, please kindly contact us at:

| HO CHI MINH CITY | HA NOI CITY |

| Doan Thi Kieu Van Associate Director 6th Floor, Star Building 33 Mac Dinh Chi, Da Kao Ward, District 1 Ho Chi Minh City, Viet Nam Tel: +84 28 6291 4188 – Ext.311 M: + 84 933 485 965 Email: vandtk@talentnetgroup.com | Do Thi Thu Huong (Anne Do) Associate Director 5th Floor, Horizon Towers Building 40 Cat Linh, Cat Linh Ward, Dong Da District, Ha Noi, Viet Nam Tel: (+84 24) 3936 7618 – Ext. 119 M: (84) 912577899 Email: huongdtt@talentnetgroup.com |