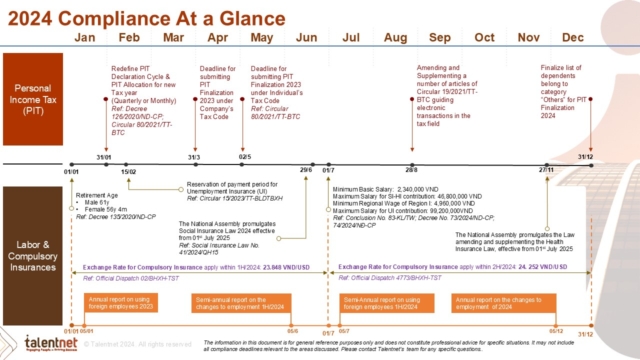

2024 Compliance Overview: A Guide for Businesses

December 24, 2024

Don't miss these crucial changes in Personal Income Tax, Labor & Compulsory Insurances in 2024! Let’s take a look at major changes and revisit them to prepare for business compliance.

1. Personal Income Tax (PIT)

- January 31: Redefine PIT Declaration Cycle & PIT Allocation for new tax year (Ref: Decree 126/2020/ND-CP; Circular 80/2021/TT-BTC)

- March 31: Deadline for submitting PIT Finalization 2023 under Company’s Tax Code

- May 02: Deadline for submitting PIT Finalization 2023 under individual’s Tax Code (Ref: Circular 80/2021/TT-BTC)

- August 28: Amending and Supplementing a number of articles of category “Others” for PIT Finalization 2024

- December 31: Finalize list of dependents belong to category “Others” for PIT Finalization 2024

2. Labor & Compulsory Insurances

2.1 Labor Compliance

2.1.a Changing in Retirement Age in 2024:

- Male: 61 years old.

- Female 56 years and 4 months.

Ref: Decree 135/2020/ND-CP

2.1.b: Changing in Salary from July 01:

- Minimum Basic Salary: 2,340,000 VND

- Maximum Salary for SI-HI contribution: 46,800,000 VND

- Minimum Regional Wage of Region I: 4,960,000 VND

- Maximum Salary for UI contribution: 99,200,000VND

Ref:

Conclusion No. 83-KL/TW;

Decree No. 73/2024/ND-CP; 74/2024/NĐ-CP

2024 Compliance key dates & what business should know

2.2 Compulsory Insurances

2.2.a Exchange Rate for Compulsory Insurance

- 1H/2024: 23,848 VND/USD (Official Dispatch 02/BHXH-TST)

- 2H/2024: 24,252 VND/USD (Official Dispatch 4773/BHXH-TST)

2.2.b Compulsory Insurance laws in 2024:

- February 15: Reservation of payment period for Unemployment Insurance (UI) (Ref: Circular 15/2023/TT-BLDTBXH)

- June 29: The National Assembly promulgates Social Insurance Law 2024 effective from 01st July 2025

- November 27: The National Assembly promulgates the Law amending and supplementing the Health Insurance Law, effective from 01st July 2025

3. Employment Report & Report on using foreign employees

- January 05: Annual report on using foreign employees 2023

- June 05: Semi-annual report on the changes to employment 1H/2024

- July 05: Semi-Annual report on using foreign employees 1H/2024

- December 05: Annual report on the changes to employment of 2024

Important Notes

- The information in this document is for general reference purposes only and does not constitute professional advice for specific situations.

- It may not include all compliance deadlines relevant to the areas discussed.

- For more information, consult with our experienced consultants at Talentnet Payroll Services.

Talk to us

Need more customized HR solutions? Call us! (+84 28) 6291 4188