Labor Regulations Update in April 2025

April 24, 2025

All information in this document is for reference and general guidance only. It is not an official advice for specific case.

DECISIONS OF THE MINISTRY OF HOME AFFAIRS ON AMENDING AND SUPPLEMENTING ADMINISTRATIVE PROCEDURES IN THE FIELDS OF EMPLOYMENT, SOCIAL INSURANCE, LABOR, WAGES, AND OCCUPATIONAL SAFETY AND HEALTH

Following the merger between the Ministry of Labor, Invalids and Social Affairs and the Ministry of Home Affairs, the Ministry of Home Affairs has recently issued a series of new decisions announcing the amended and supplemented administrative procedures in key areas of the labor market. Specifically, the decisions include:

- Decision No. 315/QD-BNV announcing the amended and supplemented administrative procedures in the field of Employment under the management scope of the Ministry of Home Affairs.

- Decision No. 318/QD-BNV announcing the amended and supplemented administrative procedures in the field of Social Insurance under the management scope of the Ministry of Home Affairs.

- Decision No. 321/QD-BNV announcing the amended and supplemented and abolished administrative procedures in the field of Labor and Wages under the management scope of the Ministry of Home Affairs.

- Decision No. 323/QD-BNV announcing the amended and supplemented and abolished administrative procedures in the field of Occupational Safety and Health under the management scope of the Ministry of Home Affairs.

Talentnet has attached these Decisions for your reference. (The documents are in Vietnamese only)

DECISION NO. 385/QD-BTC ON PROMULGATING THE FUNCTIONS, TASKS, POWERS, AND ORGANIZATIONAL STRUCTURE OF THE STATE TREASURY

On 26th February 2025, the Ministry of Finance issued Decision No. 385/QD-BTC stipulating the functions, tasks, powers, and organizational structure of the State Treasury.

Accordingly, from 1st March 2025, the State Treasury will be organized from the central to local levels under a two-tier model:

- State Treasury at the central level: 10 units

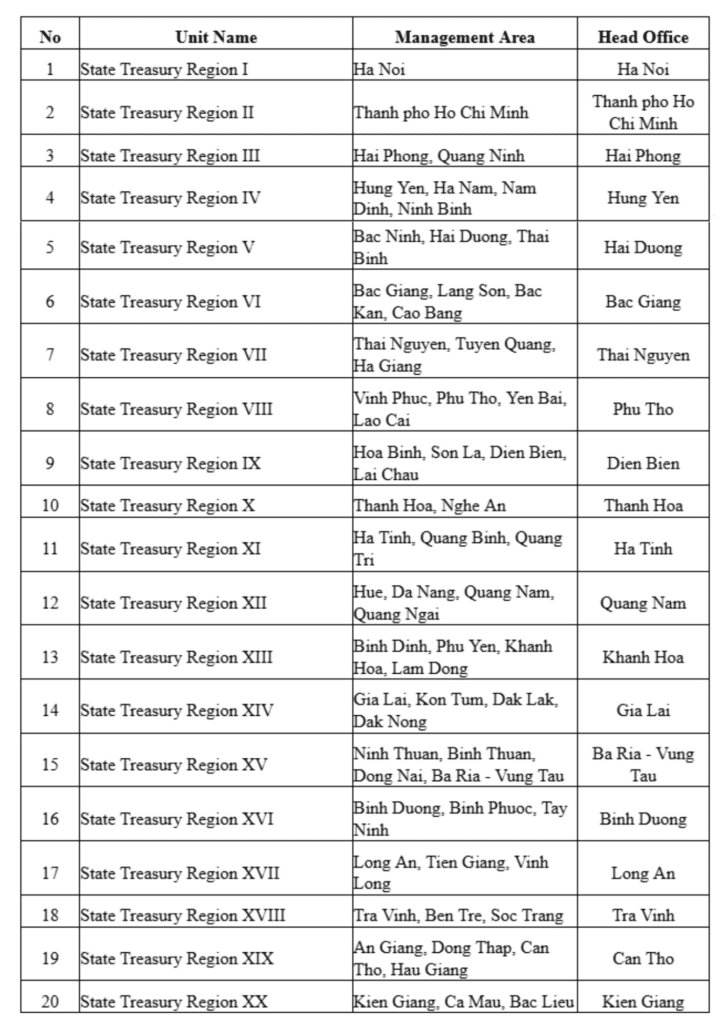

- State Treasury at the local level: 20 regions

The list of State Treasury regions under the new model is as follows:

With this new organizational structure and names, Talentnet recommends you take note and adjust your payment orders accordingly to ensure timely payments and avoid risks of late payment interest.

OFFICIAL LETTER NO. 632/CT-CS GUIDANCE ON PERSONAL INCOME TAX POLICY

On 16th April 2025, the Tax Department issued Official Letter No. 632/CT-CS providing guidance on Personal Income Tax policy related to overtime wages.

Accordingly, the income from the portion of wages and salaries for night work and overtime work that is paid at a higher rate than the wages and salaries for daytime work and work within prescribed hours according to the Labor Code is exempt from Personal Income Tax.

Talentnet recommends you correctly apply the current regulations regarding overtime work in the Labor and Personal Income Tax fields to ensure the rights of employees and comply with current regulations.