Labour Regulations Update in February 2025

February 27, 2025

All information in this document is for reference and general guidance only. It is not an official advice for specific case.

CIRCULAR NO. 86/2024/TT-BTC ON TAX REGISTRATION

On 23rd December 2024, the Ministry of Finance issued Circular No. 86/2024/TT-BTC on tax registration.

Talentnet would like to update some highlights as follows:

- Circular No. 86/2024/TT-BTC replaces Circular 105/2020/TT-BTC, which currently regulates tax registration procedures.

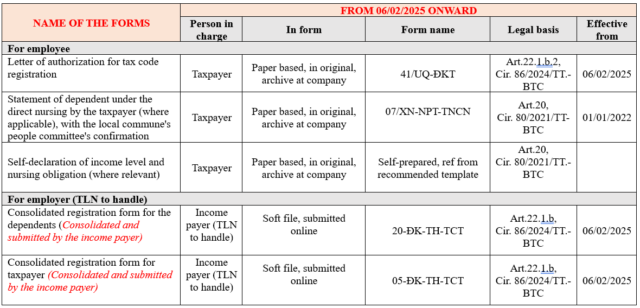

- Circular 86/2024/TT-BTC stipulates the form of tax registration authorization for both taxpayers and their dependents (Form 41/UQ-ĐKT). This Circular no longer separates tax registration forms for taxpayers and dependents. It is important to note that whenever there is a change in tax registration information, taxpayers (i.e., the Company’s employees) need to resubmit this form with the updated information and supporting documents for the change (if any).

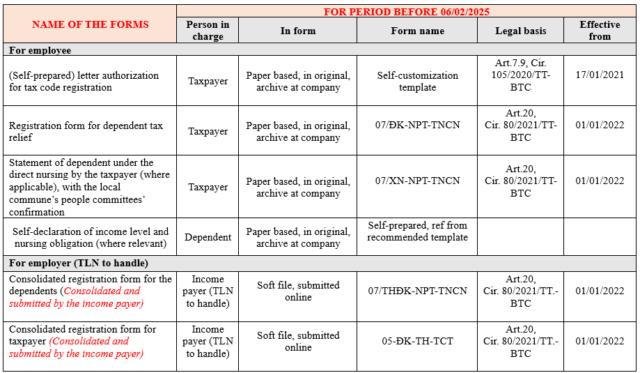

Below is a comparison table of the changes in forms for your reference:

With the issuance and effectiveness of Circular No. 86/2024/TT-BTC, Talentnet recommends that the Company review and implement it to comply with current regulations.

DECISION NO. 108/QĐ-TCT ON THE AUTOMATED PERSONAL INCOME TAX (PIT) REFUND PROCESS

On 24th January 2025, the General Department of Taxation issued Decision No. 108/QD-TCT regarding the automated PIT refund process.

Accordingly, eligible dossiers for automated processing are those that meet the following conditions:

- At the time of processing the PIT refund dossier of the taxpayer, the income-paying Organization has completed the obligation to pay the deducted PIT amount or the total PIT amount that the taxpayer as an individual has fully paid to the State Budget in the tax settlement period for which the taxpayer requests a refund;

- The PIT refund dossier has the “Total taxable income” item matching the aggregated data in the tax settlement period according to the tax management database of the Tax sector at the time of dossier processing, and has the “Total refund amount requested” item less than or equal to the aggregated data in the tax settlement period according to the tax management database of the Tax sector at the time of dossier processing;

- The taxpayer’s refund account information is verified and linked to the tax management database of the Tax sector.

With this regulation, Talentnet recommends that the Company check the obligation to pay the deducted PIT amount on behalf of the taxpayer and notify them to check, verify, and synchronize their personal information on the Tax sector’s database.

CIRCULAR NO. 15/2024/TT-BLDTBXH ABOLISHING A NUMBER OF LEGAL DOCUMENTS PROMULGATED BY THE MINISTER OF LABOR, WAR INVALIDS AND SOCIAL AFFAIRS, JOINTLY PROMULGATED

On 31st December 2024, the Ministry of Labor, War Invalids and Social Affairs issued Circular No. 15/2024/TT-BLDTBXH on the abolition of several legal documents issued by the Minister of Labor, War Invalids and Social Affairs.

Circular No. 15/2024/TT-BLDTBXH abolishes all 14 legal documents issued by the Minister of Labor, War Invalids and Social Affairs in which have some prominent Circulars affecting the fields of Human Resources, Labor and Wages:

- Circular No. 08/2013/TT-BLDTBXH dated 10th June 2013 of the Minister of Labor, War Invalids and Social Affairs guiding Decree No. 46/2013/ND-CP dated 10th May 2013 of the Government detailing the implementation of a number of Articles of the Labor Code on labor disputes.

- Circular No. 30/2013/TT-BLDTBXH dated 25th October 2013 of the Minister of Labor, War Invalids and Social Affairs guiding the implementation of a number of Articles of Decree No. 44/2013/ND-CP dated 10th May 2013 of the Government detailing the implementation of a number of Articles of the Labor Code on labor contracts.

- Circular No. 27/2014/TT-BLDTBXH dated 6th October 2014 of the Minister of Labor, War Invalids and Social Affairs guiding the state management agency on labor to consult with Organizations Representing Employees and Organizations Representing Employers at the local level in formulating policies and laws on labor and labor relations issues.

- Circular No. 23/2015/TT-BLDTBXH dated 23rd June 2015 of the Minister of Labor, War Invalids and Social Affairs guiding the implementation of a number of provisions on wages of Decree No. 05/2015/ND-CP dated 12th January 2015 of the Government detailing and guiding the implementation of a number of contents of the Labor Code.

- Circular No. 29/2015/TT-BLDTBXH dated 31st July 2015 of the Minister of Labor, War Invalids and Social Affairs guiding the implementation of a number of provisions on collective bargaining, collective labor agreements and settlement of labor disputes stipulated in Decree No. 05/2015/ND-CP dated 12th January 2015 of the Government detailing and guiding the implementation of a number of contents of the Labor Code.

- Circular No. 17/2018/TT-BLDTBXH dated 17th October 2018 of the Minister of Labor, War Invalids and Social Affairs regulating self-inspection of Enterprises’ implementation of Labor Laws.

With the abolition of these Circulars, Talentnet recommends that the Company refers to the relevant documents of the 2019 Labor Code and the documents guiding this Labor Code for application if any related issues arise.

This Circular takes effect from 15th February 2025.