A Step-by-Step Guide for Leaders: Doing Business in Cambodia

March 20, 2025

Did you know Cambodia allows 100% foreign ownership for most business types, offering a direct path to tapping into a growing Southeast Asian market?

Key Takeaways

- Cambodia stands out by allowing 100% foreign ownership in most sectors, making it easier for global companies to enter the market.

- The updated 2021 Investment Law provides strong protections and attractive incentives, aiming to draw foreign investment.

- Business registration is becoming easier thanks to online systems like CamDX and the official registration portal.

- Leaders should plan carefully to handle challenges like infrastructure gaps, complex rules, and specific land ownership restrictions for foreigners.

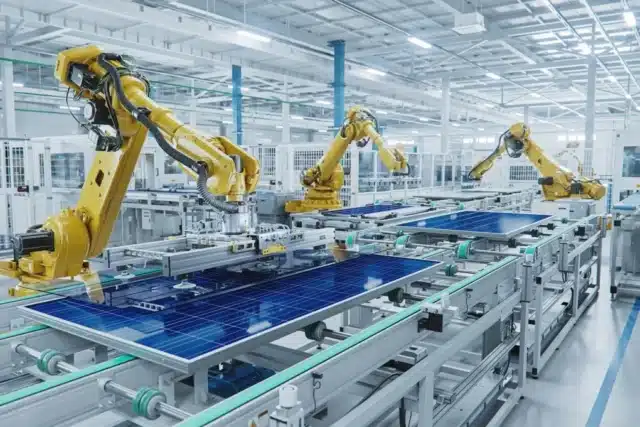

- Special Economic Zones (SEZs) offer major benefits like tax breaks and duty exemptions, ideal for manufacturing and logistics firms.

Cambodia is increasingly drawing interest from global business leaders as an attractive investment location. This appeal comes from a mix of open investment policies, a key position within the growing ASEAN region, and positive economic growth. Understanding the nuances of doing business in Cambodia is crucial for success. This guide provides a clear overview for foreign leaders exploring how to invest in Cambodia, covering the landscape from the overall climate to day-to-day operations.

Understanding Cambodia’s Investment Climate

Cambodia has worked to become a key destination for foreign investment, attracting US$2.7 billion in FDI in 2023 alone, reports indicate, with major investment from countries like China, Japan, Thailand, and South Korea. The government shows commitment through policies aimed at creating an open, clear, and positive legal environment. These efforts are key to boosting economic recovery after COVID-19 and making Cambodia more competitive within ASEAN, enhancing the environment for doing business in Cambodia.

Potential Challenges to Address

Smart investment means planning for potential problems. While Cambodia offers good prospects, leaders should plan for these challenges:

First, infrastructure gaps remain despite ongoing development. Notably, Cambodia faces high energy costs compared to others in the ASEAN region, which can affect operational costs.

Second, the country’s rules can be hard to navigate. While improving, some processes aren’t always clear, requiring care to ensure compliance.

Third, investors should know about possible requests for unofficial payments during some administrative steps; being aware and acting ethically is key.

Finally, risks exist around land rights, especially for big projects, because foreigners cannot directly own land. Also, protecting intellectual property (IP) can sometimes be inconsistent, requiring smart IP planning.

|

Entering Cambodia requires careful homework. Knowing about potential challenges with infrastructure, rules, and property early on helps leaders plan ways to manage them effectively. |

Law of Investment in Cambodia

A key part of Cambodia’s effort to attract investment is the new Law of Investment in Cambodia, introduced on October 15, 2021. This law replaced older versions and aims specifically to make the country more competitive for foreign investors. Key parts of the law aim to attract international businesses by offering basic protections against unfair seizure of assets, giving investors more security.

Importantly, it guarantees the right to manage money across borders. As the 2021 Law on Investment states, ‘investors are entitled to freely purchase foreign currencies and repatriate those currencies to settle financial obligations associated with their investments through authorized intermediary banks’. The law also includes protections for intellectual property, an important point for many businesses. To encourage growth in key areas, it offers investment incentives in 19 priority sectors, including modern industries like high-tech and R&D. Furthermore, the law helps make registration faster through online platforms and one-stop services.

How to start a business in Cambodia?

Turning investment plans into action follows a clear process, based on the 2005 Law on Commercial Enterprises (LCE). Here’s how to start a business in Cambodia:

Selecting Your Business Structure

Choosing the right legal setup is a vital first step. The LCE offers several choices for foreign investors, according to government guidelines. The most common choice is the Private Limited Company, mainly because it allows full foreign ownership. Other options include: Public Limited Companies (for larger firms planning public offerings)

- Branch Offices (extensions of foreign companies)

- Representative Offices (for market research, not sales)

- Sole Proprietorships (single owner, unlimited liability)

- Partnerships (shared ownership).

The Registration Process

Cambodia has made registration much easier, using online systems for greater speed. Here’s a typical sequence for business registration:

- Reserve Your Name: The first step is reserving your company name online through the Cambodia Data Exchange (CamDX) system, via the Ministry of Economy and Finance, which includes paying a fee.

- Prepare Documents: These usually include an application form, articles of incorporation, details on shareholders and directors, ID and address proof, a bank statement showing the minimum capital deposit (about $1,000 USD, based on official requirements), and a lease for your business location.

- Submit Application: Submit the official registration to the Ministry of Commerce’s Business Registration Department, mainly using the Online Business Registration platform. Include all documents and pay the registration fees. Approval usually takes two to three weeks, reports suggest.

- Get Certificate: Once approved, you will receive your company seals and the official Certificate of Registration, officially creating your business.

|

Cambodia’s use of online platforms for key steps like name reservation and registration makes setup much faster for foreign investors, cutting red tape and speeding up launch. |

Essential Post-Registration Steps

Receiving the Certificate of Incorporation is just the first step. To officially commence operations and ensure full HR compliance and operational readiness, businesses must complete the following procedures:

- Tax Registration: Register with the General Department of Taxation (GDT). It’s crucial to understand the main taxes: Corporate Income Tax (CIT – standard 20%, with potential incentives for small enterprises), Withholding Tax (WHT – 14% applicable to payments to non-residents/foreign contractors), and Value Added Tax (VAT – standard 10% applicable in relevant sectors).

- Labor and Social Security Registration: Register with both the Ministry of Labor and Vocational Training (MLVT) and the National Social Security Fund (NSSF). Strict adherence to labor laws is mandatory, covering aspects such as equal treatment, employment contracts, working hours, termination procedures, and establishing competitive compensation and benefits policies.

- Industry-Specific Licenses: Obtain any necessary operating licenses required for your particular field of business.

Corporate Bank Account: Open a bank account in the company’s registered name with a local banking institution.

Practical Considerations for Doing Business in Cambodia

After registering, long-term success means understanding practical and cultural points when doing business in Cambodia.

An important point for foreign investors is property ownership. Under Cambodian law, foreigners are legally prohibited from directly owning land title. However, several alternative solutions exist:

- Through a Landholding Company (LHC): This involves establishing a company where a Cambodian partner holds a majority stake (at least 51%), allowing the foreign investor to hold up to 49%.

- Long-Term Lease Agreements: Securing a long-term lease (typically ranging from 50 to 99 years) grants stable and legally recognized land use rights without direct ownership.

- Through a Trust Structure: Utilizing a legally established trust is an increasingly popular mechanism. Official figures indicate that foreign investment channeled through trusts exceeded US$1.2 billion in 2023 alone.

Managing Finances

Good money management is key. Setting up a company bank account is an essential first step after registration. Businesses often use both US Dollars (USD) and Cambodian Riel (KHR), so you need systems to handle both currencies and potential exchange rate changes. Importantly, the Investment Law protects the right to send profits and other funds out of the country in foreign currency through authorized banks, which is important for investor confidence. Digital payments are also increasingly common.

Cultural and Operational Notes

Cultural points are important for success. Building good relationships with local partners, suppliers, and authorities is important in Cambodia and can help things run smoothly. Knowing local business customs and negotiation styles helps communication and teamwork. Because rules and customs can be complex, consider engaging local HR consulting experts to help guide you.

The main message for leaders is clear: Cambodia offers opportunity, backed by supportive laws, but needs careful planning. Investors should first do careful research, analyze the market for their specific sector, perhaps exploring insights on top sectors to invest in Cambodia to understand what business to do in Cambodia, and talk to experienced legal and business advisors on the ground in Cambodia. Our team, bolstered by Talentnet’s expanded presence in Cambodia, can support your journey. Strategic planning and informed navigation are the keys to tapping into the significant growth potential this dynamic Southeast Asian market offers.