Top Industries to Invest in Cambodia: A Guide for Foreign Investors

March 6, 2025

As Cambodia's economy expands in 2025, investors are eyeing key sectors brimming with potential. The country’s prime location in Southeast Asia, business-friendly environment, and growing consumer market make it an attractive choice for investment.

Key Takeaways:

- Cambodia’s economy shows strong growth potential, with GDP forecasted to increase by 6.3% in 2025, creating clear opportunities for strategic investment.

- The industrial sector, especially manufacturing, is set to lead this growth with an expected 8.6% expansion in 2025, boosted by exports, supportive policies, and Special Economic Zones.

- Agriculture remains vital, contributing significantly to GDP and jobs, offering potential in rice production and increasingly popular high-value crops.

- Tourism is making a strong comeback, projecting 7 million visitors by 2025, supported by Cambodia’s cultural appeal and major infrastructure upgrades.

- Attractive government incentives and Cambodia’s central location in ASEAN make it a prime spot for foreign investment.

Cambodia is quickly becoming a key investment destination in Southeast Asia. Its accelerating economic growth, driven by active government support and smart initiatives, offers a landscape full of opportunity for business leaders. Economic projections point to a strong GDP increase of 6.3% in 2025, showing continued positive momentum. This guide explores the most promising areas for investment across Cambodia’s key industry sector in Cambodia, using current data and strategic insights.

Agriculture and Agro-processing

Agriculture is a cornerstone of the Cambodian economy and a significant industry sector in Cambodia. Official data indicates that 75% of the population lives in rural areas, and over 35% of the workforce is employed in agriculture (as of 2021). This sector is a major economic force, with reports showing agricultural exports hit $4.8 billion in 2024, making up about 22% of GDP.

Investment opportunities here are varied. Rice is the main crop, and Cambodia exported over 656,000 tonnes of milled rice in 2023, aiming for one million tonnes by 2025. Beyond rice, there’s growing potential in crops like cassava, mangoes, bananas, cashew nuts, and pepper – a diversification trend seen over the last decade.

Furthermore, insights from IPS Cambodia suggest significant opportunities in buying agricultural land and factories, and in building processing plants to add value to Cambodia’s natural resources for both local and international markets. The government actively encourages this sector with incentives such as tax breaks, duty-free machinery imports, and support for modern farming methods.

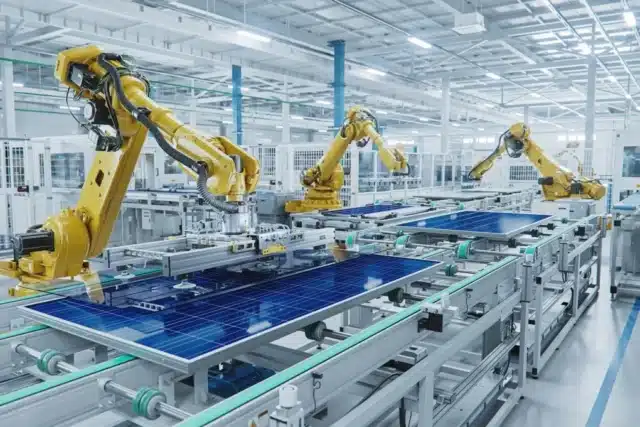

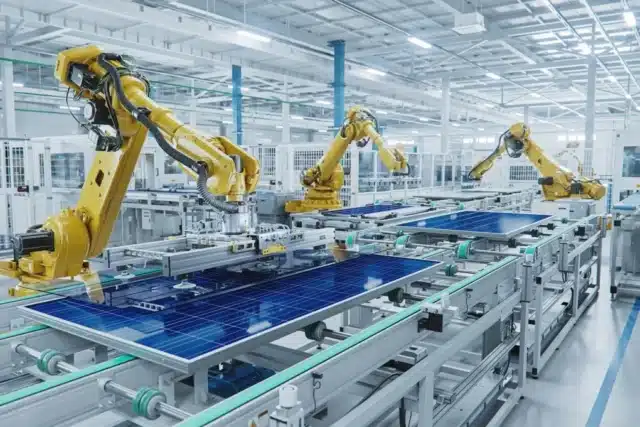

Manufacturing

Cambodia’s manufacturing sector is expanding quickly and is expected to be the main driver of the nation’s economic growth in 2025. The Better Cambodia forecasts an impressive 8.6% expansion for the industrial sector overall, making it one of the major industries in Cambodia. This growth is powered by competitive labor costs, beneficial trade deals, and policies friendly to investors.

The Garment and Textile industry is still the leader, responsible for about 74% of yearly merchandise exports, according to Realestate. It’s gaining from rising global demand and the government’s focused development strategy for 2022-2027.

However, the growth isn’t limited to clothing. Non-garment manufacturing – including electronics, automotive parts like electric motorcycle assembly, and food/beverage processing – is also steadily growing thanks to international demand, as reported by The Better Cambodia and the Phnom Penh Post.

Key investment areas therefore include Garments and Textiles, Light Manufacturing (like electronics), Automotive Parts, Furniture, and Luggage. In this competitive environment, it’s crucial to understand why paying right matters to attract and retain talent. Businesses can also leverage tools to access accurate salary market data to ensure their compensation strategies are competitive.

Cambodia’s Special Economic Zones (SEZs) are a major draw for manufacturers. As reported by ASEAN Briefing, Cambodia has 30 SEZs (26 operational), which have attracted $8.9 billion across 745 projects and generated over $5 billion in exports in 2024. These zones provide clear advantages, including competitive labor costs and helpful policies like tax holidays, zero-rate VAT, and exemptions from import duties. Successfully operating within these zones often requires support to ensure HR and administration compliance with local regulations.

|

Investing strategically in Cambodian manufacturing, especially within SEZs, provides access to cost-effective production, government support, and vital export routes through trade agreements. This makes it a smart move for strengthening regional supply chains. |

Tourism and Hospitality

Tourism is essential to Cambodia’s economy, built on its rich cultural history, best known for the Angkor Wat temples. The sector is bouncing back strongly after the pandemic. Official figures showed Cambodia welcomed 5.43 million international tourists in 2023, and projections suggest this could reach 7 million visitors by 2025.

This recovery creates excellent investment opportunities in areas like Hotels and Resorts, Restaurant Chains, Cultural and Eco-Tourism Services, and Entertainment Facilities. Growth is backed by major infrastructure projects aimed at making travel easier and improving visitor experiences.

For instance, ASEAN Briefing notes the Techo International Airport, opening in early 2025, will initially serve 13 million passengers a year, and the Kampot International Tourism Port will improve access to coastal areas.

Additionally, supportive government measures include simplified travel procedures like e-Visas and a focus on eco-tourism projects, creating a welcoming climate for investors. Reports also indicate that food services within tourism are steadily improving.

Financial Services

Cambodia’s financial services sector has grown considerably over the past two decades, offering various opportunities for investors. The sector is quite large, including over 59 commercial banks, 9 specialized banks, and 86 microfinance institutions.

Key areas within finance include Banking, Microfinance, Insurance, and the fast-growing FinTech segment. Investors find support from the National Bank of Cambodia and benefit from the practical advantages of Cambodia’s highly dollarized economy, which simplifies business and lowers foreign exchange risks.

Real Estate and Construction

Fast-paced urbanization and major infrastructure projects continue to drive Cambodia’s real estate and construction sectors. A strong sign of activity comes from government approvals indicating fixed-asset investment projects worth about $2.2 billion were greenlit in the first quarter of 2024 alone – a massive 649% increase compared to the same period in 2023.

Key investment areas cover Commercial Real Estate in cities, Residential Developments for the growing urban population, facilities within Special Economic Zones, and Tourism-Related Properties. It’s worth noting that infrastructure projects drew roughly 44% of total investment capital in 2023, according to the Phnom Penh Post.

The legal framework offers advantages like easier foreign ownership rules for some condo developments and long-term property leases (up to 50 years, renewable), as confirmed by sources like IPS Cambodia. While determining what is the best business in Cambodia is complex and depends on investor goals, the scale of activity in construction makes it undeniably significant.

|

Even if some real estate segments see slower near-term growth, the large volume of approved investments and ongoing infrastructure work highlight the long-term strategic role of construction and property development in Cambodia’s progress. |

Education

Cambodia’s education sector is expanding to meet the demands of its young population and growing economy. Government commitment is clear, with World Bank data showing education spending reached 3% of GDP in 2023.

Investment opportunities are present at various levels: Private Higher Education, K-12 Schools, Technical and Vocational Training (TVET) centers focused on workforce skills, and modern EdTech platforms.

Government incentives provide significant benefits for educational institutions, including exemptions from Tax on Income (ToI) for scholarships until 2028, VAT exemptions on educational services, and Minimum Tax (MT) exemptions. This creates a positive atmosphere for private investment in education. Understanding these nuances requires careful planning, potentially benefiting from expert HR consulting solutions tailored for the Cambodian market.

Cambodia clearly stands out as an increasingly attractive investment destination within the vibrant ASEAN region, offering a strong proposition for international companies considering Invest in Cambodia. By focusing strategically and taking advantage of what Cambodia offers, businesses can position themselves for success and profit in this dynamic economy, supported by Talentnet’s comprehensive HR solutions in Cambodia.