Vietnam Labour Law Update (April 2017)

May 5, 2017

Official derease in contributions to the fund for work-related accidents and occupational diseases with effect from 1 June 2017

Official derease in contributions to the fund for work-related accidents and occupational diseases with effect from 1 June 2017

Decrease to 0.5% in employers’ unemployment insurance contributions until 31 December 2019

I. OFFICIAL DECREASE IN CONTRIBUTIONS TO THE FUND FOR WORK-RELATED ACCIDENTS AND OCCUPATIONAL DISEASES WITH EFFECT FROM 1 JUNE 2017

The Government issued Decree No. 44/20175/ND-CP on 14 April 2017, providing compulsory social insurance contributions to the fund for work-related accidents and occupational diseases.

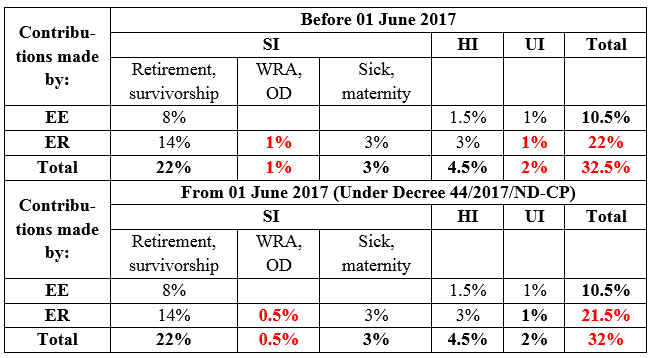

This Decree states that the monthly contribution rate made by the employer (“ER”) to the fund for work-related accidents (“WRA”) and occupational diseases (“OD”) shall only be 0.5% of the salary bill subject to social insurance contributions for their employees (“EE”).

This Decree will take effect from 1 June 2017. Therefore, enterprises should please note the need to adjust the total compulsory social insurance contribution rate from 18% down to 17.5% starting from 1 June 2017.

Below is the table summarizing contributions of social insurance (“SI”), health insurance (“HI”) and unemployment insurance (“UI”), for your further information

II. DECREASE TO 0.5% IN EMPLOYERS’ UNEMPLOYMENT INSURANCE CONTRIBUTIONS UNTIL 31 DECEMBER 2019

At the National Assembly’s regular meeting in March 2017, the Government approved the proposed adjustment of unemployment insurance contributed by employers stipulated in Article 57 of the Employment Law, from 1% down to 0.5% of the employees’ monthly salary fund subject to unemployment insurance contribution, with the aim of supporting enterprises’ development. The adjustment shall apply from the effective date of the National Assembly’s Resolution until the end of 31 December 2019.

We will follow this up closely and update you on progress when the National Assembly’s Resolution is issued.

This is not a formal legal document.

All information in this document is for reference and general guidance purposes only.

Kindly contact to Talentnet consultant to apply with respect to specific cases:

Payroll and HR Outsourcing Services

Ho Chi Minh City

Nguyen Thi Thanh Huong

Hanoi

Nguyen Thi Thu Huong

Do Thi Thu Huong